Smart Knit Crocheting

Knitting and Crochet for Beginners

Knitting and Crochet for Beginners: The Smart Way

Have you caught the knit or crochet bug yet? It's not a germ, but it could become addictive.

Knitting and crochet for beginners, the smart way is for anyone who loves to knit or crochet?

Or, for anyone who thinks they might like to give knitting or crocheting a try. So, which one is better, easier, more fun?

Where do you want to start?

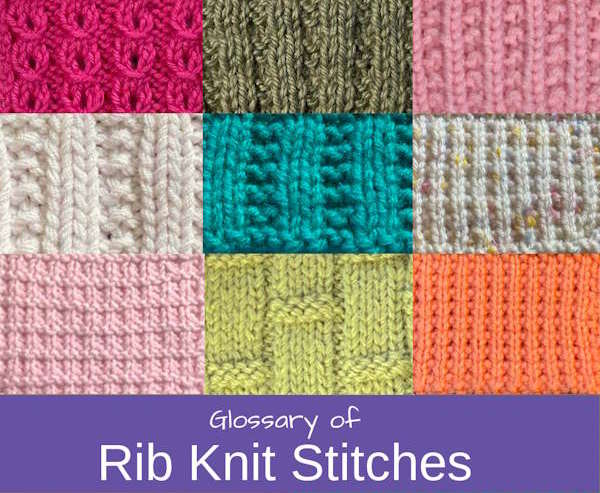

📖 Glossary of Knit Stitches

Explore textures with clear instructions, charts, and swatch photos.

Explore knit stitches →

📖 Glossary of Crochet Stitches

From basics to decorative stitches with step-by-step tutorials.

Explore crochet stitches →

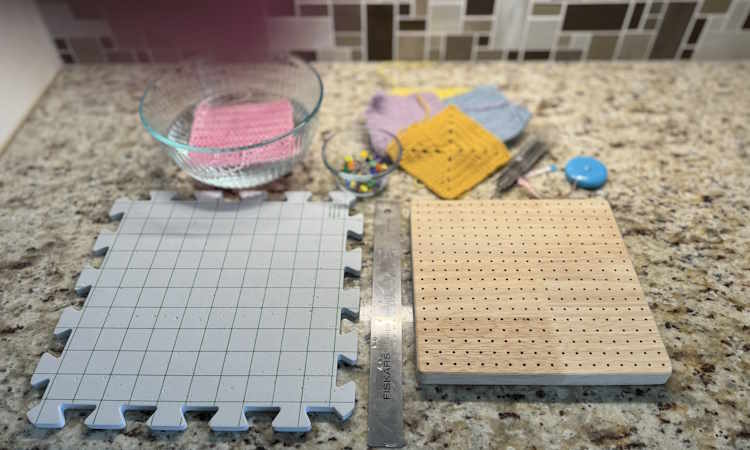

🛍️ Knitting Supplies Guide

Needles, notions, and beginner-friendly tools—what to buy and why.

Read reviews →

🛍️ Crochet Supplies Guide

Hooks, accessories, and notions for smooth, stress-free crocheting.

Learn more →

🎁 Free Knitting Patterns

Beginner-friendly projects like dishcloths, scarves, and simple hats.

Start knitting →

🎁 Free Crochet Patterns

Quick wins for beginners: home, gifts, and practical everyday items.

Start crocheting →

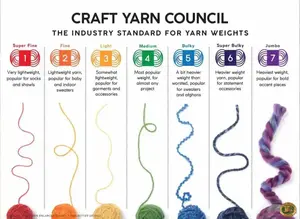

🧵 Comprehensive Guide to Yarn

Fibers, weights, care, and how to choose the right yarn for any project.

Yarn guide →

📚 More Resources

Tips, calculators, sizing charts, care guides, and printable checklists.

See resources →

More Articles on Smart Knit Crocheting

Crochet Tutorials for Working in the Round

Beyond learning a few stitches, there are other techniques to know. This article will cover all the essential skills that crocheters need to know.

Beyond learning a few stitches, there are other techniques to know. This article will cover all the essential skills that crocheters need to know.Why Knitting and Crocheting for Beginners?

There's something so satisfying about using your hands to make something. Research has shown that these hobbies are good for your health.

Knitting and Crocheting could very well be the

- Most versatile

- Most portable

- Most inexpensive

- Most fulfilling way to add meaning to your life

So How Exactly do you Knit or Crochet Smart?

Many years ago, when I was in high school, there were 3 kinds of kids:

- Those A students who memorized everything

- Those C students who didn't try at all and

- Those A-B students who actually understood the subject matter at it's core.

I want you to be the last kind of student because in the long run you will knit or crochet better, enjoy it more, and make it a life-long hobby (or maybe something more).

(Confession) I was always in the first group and it took many years to figure out that I should have been in the third group.

Knitting and Crocheting for Beginners

Knitting and Crocheting for BeginnersYou're knitting or crocheting smart when you

- Learn a few techniques and stitches to get you started

- Practice and develop that muscle memory

- Get so hooked all you want to do is learn more

- Feel the creative juices running through your veins

Have you ever been faced with one or more of these common situations?

- Understanding written and charted patterns: You've read the instructions and think you understand until you try to do it for yourself and that's when your eyes glaze over.

- Choose the best yarn for your projects: You walk into a yarn store, only to overwhelmed by the choices. The sales person is helpful, but you find your eyes begin to glaze over by all the info thrown your way.

- Going from Easy to Interesting: You want to go beyond knits and purls or single and double crochet stitches

- Tension, Shapping, Finishing

- Gauge: How to Make Your nits and crochets fit perfectly.

- Latest trends, tips, techniques, tutorials

Hi, there, I'm Janice, the voice behind this website and avid knit and crochet enthusiast. I want to share my passion with you and help you learn how to knit or crochet, smarter.

Happy Knitting and Crocheting!

My Latest Articles

Recent Articles

-

Easy Knitting Stitches for Blankets

Mar 09, 26 04:24 PM

Discover these easy, beginner-friendly knitting stitches that are perfect for blankets of all sizes. -

24 Best Knitting Stitches for Scarves: A Complete Beginner's Guide

Mar 07, 26 02:25 PM

Here is my collection of the best stitches for knitting scarves for beginners along with free tutorials and directions to complete the projects. -

Granite Lace Knitting Stitch: Step-by-Step Tutorial

Mar 06, 26 02:28 PM

The granite lace knitting stitch is a lovely lacy textured knit stitch that is beginner-friendly and perfect for blankets and scarves.